Cindy’s Newsletter for Gift Shop Managers | Aug 15, 2025 💮

| Newsletter for Gift Shop Managers |

The Newsletter for Gift Shop Managers delivers practical, actionable content for gift shop managers, buyers, and volunteers. Since its launch in 2001, it has been a free, independent publication helping retailers optimize operations, increase revenue, and connect with one another. Starting in 2025, the newsletter will be published mid-quarter —in February, May, August, and November.

Its value comes from a close-knit, engaged community. We invite you to leave a comment or join the conversation in the Hospital Gift Shops Facebook Group, a private community for hospital gift shop professionals.

August 15, 2025

Does anyone feel like we’re back in the throes of the pandemic? Right back in survival mode. Scrambling for solutions, looking for direction, facing uncertainty everyday. Tariffs are causing havoc in the retail industry and raising prices. Buyers found that most vendors have instituted 5-15% pricing surcharges at this summer’s gift markets.

Yet again, this may not be your experience at all. This is great!

There are varying levels of concern and experiences, adding to further confusion. Many retailers are reporting a drop in sales while others report that sales are holding steady. Variables like location, customer loyalty, vendor relations and more are at play here.

While no one can say definitively say what will come, consider—with weighted caution—a few possible scenarios for the future :

1) Pre-tariff pricing has likely boosted recent sales, possibly resulting in false confidence;

2) There will be medium strain over holidays due to cautious consumers;

3) Summer market pricing may not fully pass through; will be category specific; has potential to misalign with consumer impressions

4) early 2026 will see slow discretionary spending recovery, counterweighted by real earnings up YoY. Net: mild softness more likely than a snap-back.

These are complicated and unpredictable times. There is no one answer or scenario. The only certainty right now is uncertainty. But knowing and preparing for multiple possibilities is always smart.

One caveat before we dive in, we are not economists, things are constantly changing, no one has the the answers. We did our best to bring you a complete picture.

Let’s get into it!!

💮 💮 💮

Tariff talk … and fatigue

Takeaways from “‘Tariff Fatigue’ Falls Over Las Vegas Market as Buyers Grapple With Filling Inventory”, Gifts & Dec, Aug 5, 2025

Headlines coming out of the summer markets are all about tariffs:

“Talk of tariffs hangs over summer edition of Atlanta Market”

“Tariff fatigue falls over Las Vegas Market”

“Dallas Market Center announces new initiative to Turn Off Tariffs”

Perhaps the biggest takeaway from Las Vegas was that the tariff-induced price increases were the real deal. Retailers placing their orders for last-minute Fall goods, holiday merchandise and even first quarter 2026 found that increased prices were no longer theoretical.

“It wasn’t all about tariffs at the recent edition of Atlanta Market… but it was pretty close.” —Warren Shoulberg, Contributing Editor for Gifts & Dec

For retailers the price tags were the key factor but for vendors it was often something else. “Retailers want to know how much more something costs,” said the CEO of one big decorative accessories firm, wishing not to be quoted by name. “But for us suppliers it’s more a matter of can we get the goods.” The shutdown of factories in China and elsewhere in Asia earlier this year when the first round of tariffs – as high as 145% in China – meant that there was a gap in merchandise coming into the U.S., coinciding with the time when many orders are placed for the critical fourth quarter.

Any goods brought in before that round of tariffs – either arriving in the late winter or as holdovers from 2024 – were long gone by the time Las Vegas rolled around. “At this point there is no pre-tariff inventory in stock,” Doug Cofiell, CEO of Ivystone, said at a panel on tariffs held at the World Market Center. “Large companies purchased all the inventory before the increased tariffs went into effect earlier this year.”

Import cargo for 2025 is projected to sink 5.6%, meaning fewer products available to purchase and restock. —National Retail Federation (NRF)

Cofiell, who said that even if orders were placed earlier in the year, if they arrived in U.S. ports carrying higher duties those were being passed along to retailers. He added that he thought shoppers were starting to better understand the impact these higher import costs would have on the things they were buying. “I think consumers began to realize something was up when Walmart and Amazon raised prices.”

Interior designer Christopher Grubb, president of Arch-Interiors Design Group and another speaker on the tariff seminar panel, said it was increasingly difficult to do business when prices were going up all the time. “The day-to-day reality is that we often find out the price after the product has landed in the U.S. For us, the surcharge is a reality and it’s cutting into our profit.”

SOURCE: Gifts & Dec

A compressed 2025 holiday season

Only 26 core holiday shopping days!!

Retailers face a compressed 2025 holiday season: just 26 core shopping days between Black Friday (November 28) and Christmas (December 25) making it the shortest window in years.

Add a cautious consumer, economic pressure, and mounting competitive chaos, and you’ve got a holiday environment that demands one thing above all else: precision.

Tariff tools and industry initiatives

ANDMORE has started offering new programs to help support businesses during the economic uncertainty brought on by the Trump administration’s tariffs. It is also leveraging its public relations resources to secure vendor and retailer media placements in national outlets, raising awareness of the industry’s challenges and intensifying pressure on decision-makers in Washington.

They have partnered with Bridgetower Media – the company behind Furniture Today, Gifts & Dec, Home Accents Today, Home Furnishings News and other trusted outlets – to create the Tariff Tracker, designed to keep the industry up to speed on tariffs.

ANDMORE has also provided some Tariff Tips to plan when and how to restock or invest in new brands. ANDMORE operates the Atlanta, High Point, Las Vegas, and New York City gift market trade shows.

Use your voice to advocate for our industry and your business. The NRF has developed a Speak Out Against Tariffs! form that you can use to contact local representatives and senators directly.

The Dallas Market Center also launched an anti-tariff initiative back in April to support independent retailers amid tariff concerns. The initiative, “Stand With Main Street. Turn Off Tariffs,” advocated for a 90-day pause on all tariffs between the United States and China, allowing for the free flow of goods critical to the upcoming holiday selling season for independent retailers. It included a petition with a goal to unify support across all retailers, manufacturers, sales representatives and other retail stakeholders. The petition was delivered to key decision makers in Washington.

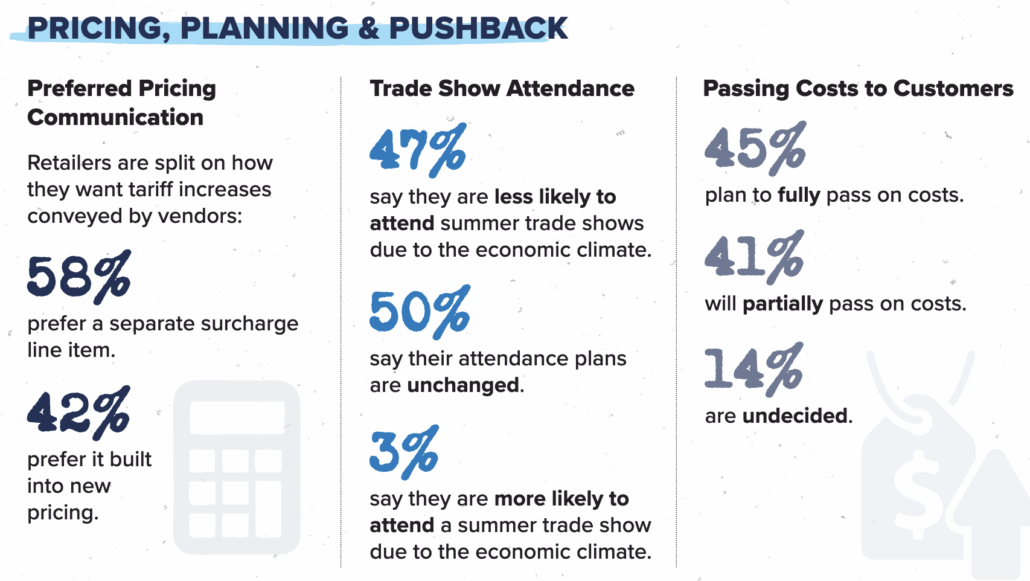

How are retailers taking on tariffs? Gift Shop® Plus surveyed retailers across the country to find out. Download the Retailer Tariff Report.

A tariff action plan

- Identify your high-margin, fast-moving imported items and assess how much stock you have.

- Secure your Q4 and early 2026 inventory sooner.

- Do not wait until late Q3 to place holiday or early spring orders; starting US port volume is expected to drop sharply (down 19.5% YOY) in September.

- Watch freight and delivery like a hawk. Tariffs can sneak into your bottom line through increased shipping and logistics costs. Stay on top of what you’re paying.

- Avoid overstocking on risky imports with volatile pricing unless you have guaranteed sell-through.

- Expect ripple effects — even U.S.-made goods with imported components may rise in price.

- Bigger retailers move slow—you don’t! Use this moment to pivot fast, discover new vendors, and provide product they can’t get.

- Capitalize on “local“: consumers are weary and anxious. Many will turn to local retailers for trust, buying confidence, and personal connection.

- Build a “tariff-proof” assortment: more local goods, fewer SKUs dependent on volatile supply chains.

- Establish tiered product pricing so you can substitute premium imports with lower-cost alternatives if necessary.

- Consider pre-holiday promotions to boost early sales while stock is strong, before the late-year slowdown hits shelves.

Displays that go outside-the-box

Let’s take a break from tariffs and talk displays! We’re big on creative displays that go outside-the-box with the use of props and unusual pieces. They may take a bit more effort but the return is worth it. After all, merchandise display and design immediately sets the tone and energy of your shop. And your customer’s feel it, conscious or subconsciously.

Shop manager, Glenn Hebert and his team at Glenn’s Flower Box Shop in Lourdes Women’s & Children’s Hospital, in Lafayette, LA exemplify this perfectly, in their window and floor displays. They create a fun, whimsical atmosphere. We also love how the ceiling props change with the season.

♡ Connect. Share. Grow. ♡

A retailer’s tariff timeline

All dates are current at time of publication on August 14, 2025, and are subject to change…..which is likely. We did our best! 🤯

| Date | Tariff Action | Retail Relevance |

|---|---|---|

| Aug 1, 2025 | Tariff truce extended 90 days maintaining China at 30% and 10% on most other countries | Short-term stability—no new rate hikes for most imports. Allows holiday orders without sudden increases, but China still higher. |

| Aug 7, 2025 | Country-specific reciprocal tariff rates take effect (0%–41%). “Goods-in-transit” grace applies to items unloaded before October 5. | Canada, China, Mexico not included |

| Aug 27, 2025 | India “secondary” tariffs begin: 25% on select goods (expanding to textiles, home goods, gift items). | Direct cost impact for retailers sourcing from India (e.g., textiles, décor). May require re-pricing or sourcing shifts. |

| Aug 29, 2025 | De minimis exemption ends, all countries: For ALL IMPORTS (even under $800) lose duty-free exemption; now subject to 15–50% tariffs based on origin. | Direct impact on small-parcel gift items and e-comm sourcing; sudden cost jumps for drop-ship & online retailers |

| Sept 1, 2025 | Labor Day | Launch early fall promotions; some back-to-school tie-ins. |

| Sep 16–18, 2025 | Atlanta Fall Gift & Home Market | Late Q4 reorder and holiday fill opportunities |

| Oct 5, 2025 | In-Transit Grace Period Ends | Goods loaded for shipment before August 7 can still enter U.S. at old tariff rates if they arrive/processed by October 5, 2025 |

| Oct 31, 2025 | Halloween | Put out holiday merch by Oct 1st. |

| Nov 10, 2025 | China tariff truce expires unless extended: Could revert to full country-specific rates (up to 50%). | Major risk point for retailers relying on China—potential sharp cost increases ahead of early 2026 seasons. |

| Nov 10–12, 2025 | Atlanta Fall Cash & Carry (Gift & Home) | Last-minute holiday stock; watch for post-tariff-change pricing |

| Nov 27 & 28, 2025 | Thanksgiving + Black Friday | Deep discount promotions; move inventory aggressively |

| Dec 25, 2025 | Christmas | |

| Late 2025 – Early 2026 | Possible baseline rate change (proposal: 15–20%). | Would affect all imports equally; monitor trade announcements for final decision and effective date. |

| Jan 2026 | Conduct a Physical Inventory in January, when sales are slower. | Having a handle on inventory is more important than ever. Free guide How to Conduct a Physical Inventory |

| Feb 1–3, 2026 | NY NOW Winter Market, NYC |

Five trends that stood out at Atlanta Market

Amanda Erd, Managing Editor, Gifts & Decorative Accessories recently shared several trends that stood out to her at this year’s Atlanta Market.

🎯 TIP: The country’s Semiquincentennial is on July 4, 2026. Mark your buying calendar and stock up!

Fruit-themed items

Quirky and fun candle holders

Bows, of every color, shape and size, aren’t just for holidays

Patriotic decor will trend hard with the Semiquincentennial on July 4, 2026

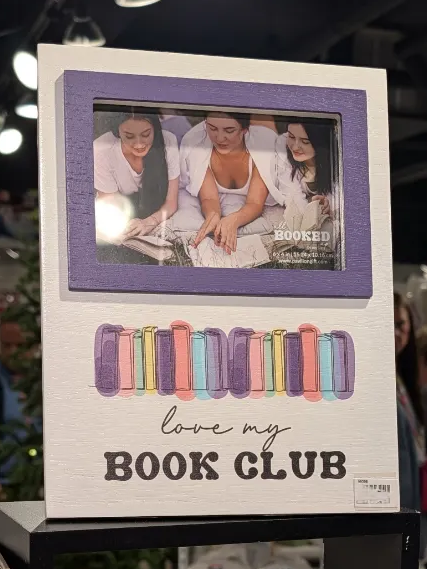

Book and reading themes in gifts and decor

SOURCE: Gifts & Dec

Tariff insights, strategies, and predictions

We put these through AI to provide you with a quick summary. Click through to read or view the full content.

The Tariff Effect: Sourcing, Pricing, and Staying Competitive

Tariff panel discussion, Las Vegas Market | July 2025

- Brief spike: consumer spending increase in July is driven by a summer of shoppers purchasing ahead of tariffs.

- Customers rarely ask about tariff-free goods, but there’s modest interest in “Made in USA”.

- Panelists agreed tariffs are inflationary in the short term, though the effect may be a one-time hit rather than ongoing.

Advice from the Panel

- Be transparent with customers about price increases, but frame them in terms of general cost rises, not just tariffs.

- Monitor market prices closely to stay competitive.

Tariffs and Trade: What Gift & Home Retailers & Suppliers Can Do to Succeed

Tariff panel discussion, Atlanta Market | July 2025

- 65% of retailers expect tariffs to disrupt business; 50% don’t know how to explain price hikes to customers.

- Halloween/Back-to-School shipments are delayed and a 15-20% cancellations is expected. Estimate is only 80% fulfillment for some retailers. There is no pre-tariff inventory left with major suppliers.

- Christmas/Holiday inventory status is erratic—some have stock while others are not shipping yet, with a 10–15% shortfall in supply. Pre-tariff inventory is already purchased by proactive retailers; none left with major suppliers. Some large orders canceled; retailers seeking alternative sources.

- Strategy – offer existing stock, previously purchased goods at old prices, with cutoff dates to drive orders.

- Made-in-USA demand exists but their price gap — approximatly 50% more —limits volume and isn’t viable in certain categories.

- Strategy – product mix of budget-conscious and luxury sourcing to manage perception and quality.

- Accept lower margins on some items to maintain vendor relationships.

Advice from the Panel

- Avoid panic from constant news. Focus on doing what you do best.

- Serve customers exceptionally well; improve efficiency; support partners.

- Retail exists to make life better—lean into events, joy, and experiences.

- Flex your “shop local” arm to take advantage of trust and relations.

Adapting to Disruption: How Top Main Street Retailers Are Navigating Tariffs

Tariff panel discussion, Dallas Market Center | May 2025

This is a raw discussion on the likely impact tariffs will have on retail in, at least, the near future. It has more warnings and risk awareness rather than optimism. Tariffs and supply chain disruptions are seen here as severe, urgent problems. The panel is cautionary, with a heavy dose of “prepare for the worst.”

Perhaps the strongest expression is one of uncertainty—even if tariffs are resolved quickly, and warnings that cargo delays and shortages are inevitable.

Inflation, declining customer traffic, and unstable pricing are of real concern. The “Stand with Main Street / Turn Off Tariffs” campaign underway underscores the seriousness and political advocacy required from the industry.

We suggest you give this one a listen.

One word… uncertainty. —Ashley Alderson, The Boutique Hub

Navigate uncertainty through smarter sourcing & stronger relationships

- Gift sector hit harder due to long pre-orders & manufacturing locations.

- Brands handled tariffs differently — absorbed cost, increased prices, or added tariff line item.Retailers sourcing smarter (learning actual origin countries).

- Stronger retailer-brand relationships.

- Better inventory & margin management.

It’s not so much ‘Made in America’ as it is ‘not from China.’ —Allison Dodson, A. Dodson’s Gift Shop

Shift in consumer focus to origin loyalty

- Consumer concern less about “Made in America,” more about not from China.

- Customers are talking openly about tariffs.

- Community connection as the anchor in unpredictable markets

- Apparel sales boosted by Shein/TEMU absence.

Days without people coming into the store at all … it’s just kind of caused chaos…— Kenneth Ludwig, Kenneth Ludwig Chicago

Adjust product mix to sustain traffic amid soft retail

- Retail traffic down; events and in-person shopping slow.

- Furniture division strong; retail uncertain.

- Plans to focus on consumables, gift packaging, and made-in-USA items.

It’s like Russian roulette… you still have to have stuff in your store otherwise people think you’re going out of business.—Sara Faircloth, Faircloth Boutique

Educate customers and adapt product selection

- Tariff handling by suppliers varies; appreciates those absorbing costs.

- Educating customers on impacts of buying from Shein/TEMU.

- Strategy: avoid holiday-specific apparel in favor of versatile, season-spanning styles.

- Events are having major customer draw.

If you think you can wait until fall to place holiday orders, you’re already too late. The trucks won’t make it in time. —Beth Rich, Mix It Up, Coeur d’Alene, ID

Supplier transparency and product flexibility to safeguard margins.

- Inventory urgency: order holiday merch now!

- Strong supplier communication appreciated.

- Tariff surcharges over price hikes (“price hikes never come back down”).

- Holiday: only 25% store holiday-focused to reduce post-season markdowns.

Actionable Tips & Operating Advice

Sourcing & Product Strategy

- Select color palettes & styles that work beyond holiday for longer shelf life.

- Stock consumables and core gift items to stabilize revenue.

Inventory & Buying

- Order early with flexible dating terms.

- Build backup vendor lists in case of delivery failures.

Pricing

- Prefer visible surcharges over permanent price increases.

- Strategically raise prices where market will bear it.

Marketing & Events

- Signage with product origin stories.

- Leverage collaborations with other local retailers.

Operations

- Staff checks for unannounced price changes on invoices.

- Maintain transparent customer communication on tariffs & local impact.

Customer Experience

- Elevate in-store experiences (complimentary snacks/bev).

- Use scarcity and urgency (limited sizes/quantities) to drive quick purchases.

Navigating Economic Uncertainty: How Data Helps Retailers Stay Resilient

Management One Inc.

Key Point: Disruption can create opportunity. What matters is how you pivot and respond.

Evaluate Current Performance Data

- Focus on the last 3–6 months, not year-over-year comparisons.

- Track: top-selling categories and vendor pricing

Know Your Financial Position

- Identify break-even point for each store.

- Maintain visibility on cash flow, budget, and open-to-buy.

- Separate fixed vs. variable costs.

- Consider liquidity options for flexibility, but avoid overbuying.

- Cut fringe categories/duplications

Activate & Align Your People

- Meet daily and align weekly on key products and talking points.

- Train continuously on what’s selling and what’s changing.

Make Smarter Inventory Decisions

- Double down on bestsellers — buy narrow and deep; reorder quickly.

- Exit non-performers using sell-through data; markdown or cancel fast.

- Simplify vendor list with A/B/C structure; focus open-to-buy on reliable vendors.

NEWSLETTER ARCHIVE

Don’t see what you’re looking for? Search over 4 years of articles in the Newsletter Archive.

Search articles on inventory control, POS software, volunteer management, online ecommerce software, sale and event suggestions, formulas for calculating shop performance, what are other shops selling and more.

It is full of valuable information and reader comments to help you run your shop.

DISCUSSION FORUM

💮 💮 💮

Discussions have moved to the

private Facebook Group

300+ members

Advice, inspiration, product best sellers

Private and vetted membership

Hospital gift shop professionals only!

♡ Connect. Share. Grow. ♡

Want to advertise? Click here.

© Cindy Jones Associates, 2022. COPYRIGHT PROTECTED. Redistribution, copying, reselling, re-renting, or republishing is STRICTLY PROHIBITED. Cindy’s Newsletter may not to be forwarded, redistributed, reproduced, reprinted, or posted online without prior permission from Cindy Jones Associates. Subscribers may share one issue with a fellow manager. Thereafter, the manager may subscribe here to receive future issues.